r&d tax credit calculator hmrc

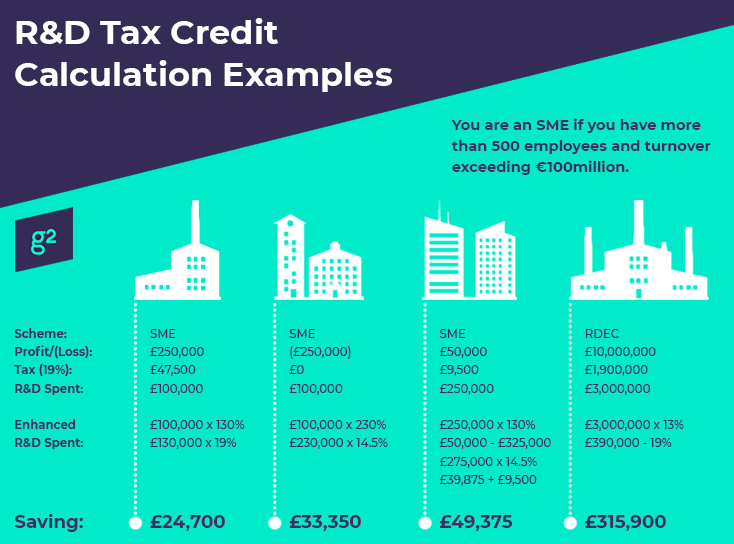

The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable. The RDEC is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017.

Test Summary Report Template 1 Templates Example Templates Example Report Template Excel Templates Templates

Calculate how much RD tax relief your business could claim back.

. To put it another way 75000 of the expenditure has already attracted relief and crucially is also does not create a loss. By answering a series of simple questions our RD tax credit calculator allows you to estimate your potential claim value whether youre due a tax reduction or a cash credit. The answer is more complicated than youd think.

Enhanced RD qualifying spend or uplift. 100000 130 130000. However beware that none of the information has been updated since 2018.

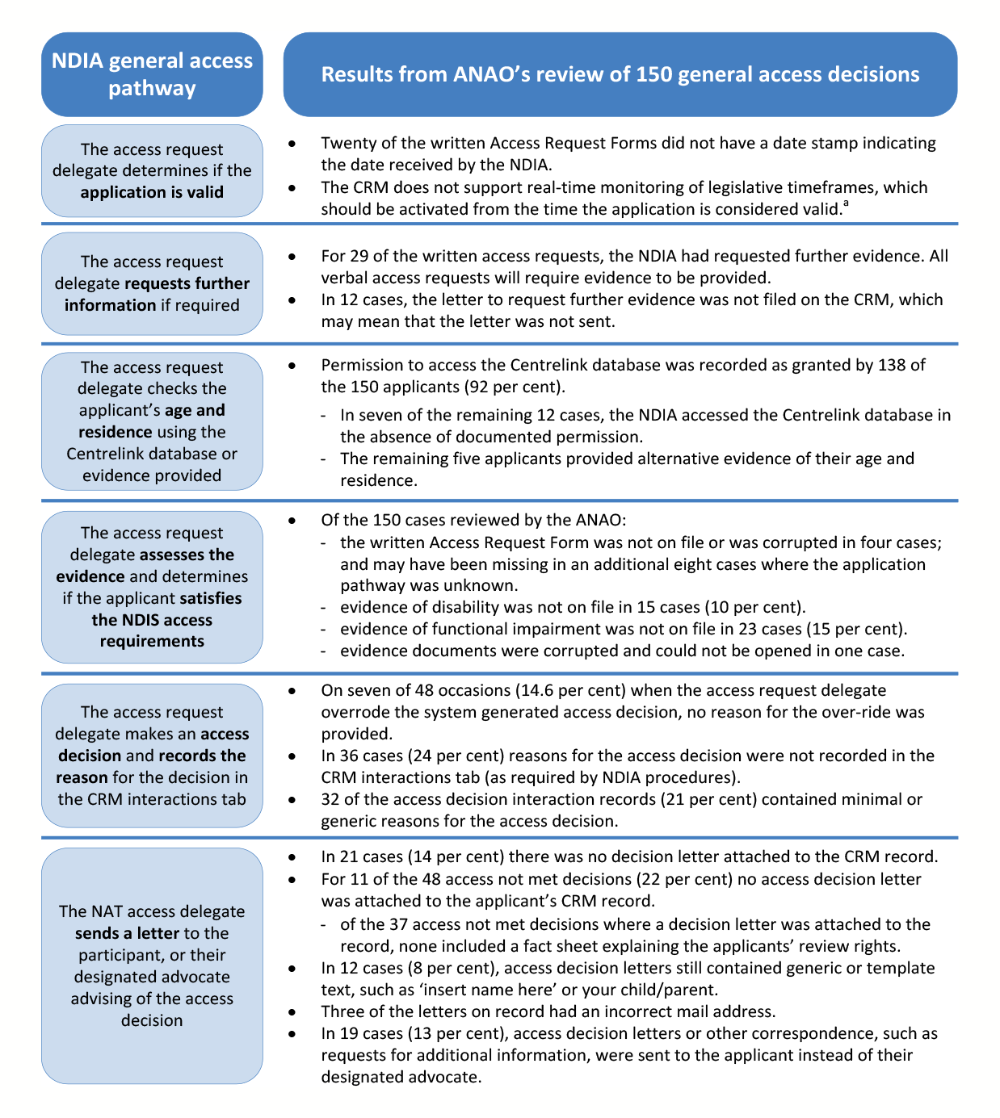

Research and Development Tax Credits are a UK tax incentive designed to encourage companies to invest in RD. RD Tax Credits Calculator. This calculation example shows how RD tax credits can benefit a company via a tax saving of 9500 and payable tax credit of 39875.

But instantly we run into a problem. Enhanced RD qualifying spent would be now 325000 x 130 which makes the revised loss of 275000. Otherwise please feel free to continue to browse this website for useful information regarding claiming RD Tax Credits in the UK.

The program provides UK businesses with either a cash credit or corporation tax deduction to compensate for up to 33 of the cost of their research and development. 100k QE in this example. If you add back the qualifying costs of 125000 the company would have a profit of 75000.

RD Tax Advisors are invited to find out more about the Inspiredtax claim preparation software. The UK governments RD tax credits scheme is designed to stimulate innovation in the UK economy. Before you can claim RD Tax Credits an excellent and lucrative source of government funding you need to work out whether your development work meets the HMRCs definition of RD for tax purposes.

If the company spent 100000 on RD projects in a year then its potential RD Credit would be 9700. Free RD Tax Calculator. Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief.

Most RD tax credit calculations or worked examples that youll see online start by establishing which schemes apply. It was increased to. Average calculated RD claim is 56000.

Calculate how much your research and development claim could be worth by using our RD tax credits calculator. The RD Tax Relief scheme allows a further deduction to be made calculated as 130 of the qualifying expenditure identified. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend.

Calculating RD Tax Credits for a Large Company Examples. First however the fix-based percentage must be obtained by dividing the QREs for tax years during a base period by the gross receipts from the same period. Select either an SME or Large company.

Corporation Tax CT before RD tax credit claim is 76000. Select whether the company is profitable or loss making. You are eligible for the RD Tax Credits SME scheme if you have less than 500 employees in your company andor group and less than 100m turnover.

If you spend money creating or improving products or services youre probably eligible for an innovation tax refund. Firstly if the accounts have not been published add this as income into the accounts. Adjusted profit loss 200000 330000 This is how the RD Uplift has increased your loss figure.

Companies can reduce their tax bill and recover up to 13 of their RD expenditure. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount. They have 2000000 of qualifying RD expenditure.

The scheme is available to businesses in all sectors as long as your activity counts. The level of tax relief can be worth around 12 of the money spent on RD which can mean you can earn 10p for every 1 spent on qualifying RD. Although a useful tool in highlighting the potential benefit RD tax incentives can bring to your business no online calculator can substitute for proper advice and is likely to either over or under estimate your.

The research development RD tax credit is designed to encourage innovation and increase spending on RD activities for companies operating in the UK. 12 from 1 January 2018 to 31 March 2020. A total 230 saving.

Guidance on this can be found on our Which RD scheme is right for my company page. On this page you can calculate the value of your Research Development tax credits claim. So the RD tax credit is 75000 145 10875 smaller.

Sometimes this is a simple matter of working out whether your business is small or large. The year end is December 2019 the RDEC rate is 12 for that year. To calculate the value of your RD tax credits simply multiply the enhanced expenditure 230 of your RD spend amount by 145.

The RDEC is 200000012240000 shown in Box 530 CT600. Just follow the simple steps below. Company X made profits of 400000 for the year calculate the RD tax credit saving.

Our free RD Tax Credit Calculator instantly crunches your numbers and shows how much in RD Tax Credits your business could claim from HMRC. In the case of your company being loss making you will receive payable tax credits in the form of cashback from HMRC which will be up to 33 of your eligible RD expenditure. HMRCs definition can be extremely difficult to.

A 130 uplift is applied to your RD costs leading to a tax reduction of 2470 for each 100 spent on RD if you make a profit. The qualifying expenditure is 100000 thats already in accounts as expenditure. Its one of the UK governments top incentives for encouraging investment in research and development and allows up to 3335 of a companys RD spend to be recovered either as a reduction in Corporation Tax or a cash.

Call 01332 819 740 infotbatcouk. In general profitable SMEs can benefit from average savings of 25 so if a company were to spend 100000 on R. As with the SME scheme the credit can be off set against your tax liability or payable in cash.

The project may research or develop a new process product or service or improve on an existing one. Sometimes its more complicated with SMEs using the RDEC scheme in circumstances that are prohibited under the SME scheme.

How To Write A Work Report Template 6 Professional Templates Report Writing Template Report Template Writing Templates

Rma Report Template 1 Templates Example Templates Example Report Template Student Learning Templates

R D Tax Credit Calculation Examples Mpa

Ndis 9 Month Report Template 7 Professional Templates Report Template Templates Professional Templates

Free Report Card Template Report Card Template 28 Free Word Excel Pdf Documents Report Card Template School Report Card Card Template

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

Medical Report Template Check More At Https Nationalgriefawarenessday Com 47015 Medical Report Template

How To Claim Hmrc Research Development R D Tax Credits Easily

How To Claim Hmrc Research Development R D Tax Credits Easily

Training Summary Report Template 9 Templates Example Templates Example Report Template Pamphlet Template Templates

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

Software Development Status Report Template 1 Professional Templates Report Template Project Status Report Free Word Document

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa

R D Tax Claims Research And Development Tax Credit

Software Test Report Template Xls 1 Professional Templates Test Plan Excel Calendar Template Software Testing

R D Tax Credits Calculation Examples G2 Innovation

Word Document Report Templates 1 Templates Example Templates Example Report Template Acceptance Testing Word Template